Intro: Technological advancements have significantly increased accessibility to a wide range of business activities, particularly investment management. Smartphone use is becoming increasingly common in emerging economies, particularly among the younger demographic. In 2018, an estimated 1.56 billion smartphones were sold globally, accounting for 52.2% of all website traffic. Currently, there are approximately 2.71 billion smartphone users worldwide. In emerging markets, the rapid increase in smartphone ownership and mobile internet adoption has catalyzed digital economic development, allowing for widespread digitalization. According to Global System for Mobile Communication (GMSA) Intelligence, there were 3.5 billion internet users in 2016, with 2.6 billion coming from emerging markets. In 2017, global mobile internet penetration reached an impressive 47%, emphasizing its dynamic and critical role in the market. A recent Pew Research Centre study reinforces the rapid global adoption of mobile technology, particularly among younger demographics who are more digitally savvy. Notably, the younger generation in many emerging countries owns smartphones at a higher rate than older age groups. (Silver, 2019).

The regulatory environment, such as the Securities and Exchange Board of India (SEBI) implemented a few regulations to protect investors' interests and ensure the integrity of financial markets (Agarwal M., 2023), which impacted the online investment market in India. To add further, the COVID-19 pandemic also acted as a accelerator, encouraging the acceptance of digital investment platforms since more people counted on digital platforms to manage their funds during lockdowns which led to increase the demand for investment in stock markets.

Many platforms now include educational content, tutorials, and market insights, which contribute to an overall increase in user financial literacy. Looking ahead, India's online investment apps appear to be poised for continued innovation and growth. The integration of artificial intelligence and machine learning is expected to improve the personalized user experience and investment recommendations. As regulatory frameworks evolve, the industry is likely to see more responsible innovation aimed at ensuring user security and trust.

As a conclusion, it can be said that the evolution of online investment apps in India has witnessed a remarkable journey from the early days of digital trading platforms to the present era of sophisticated, user-centric applications. Before the proliferation of investment apps, investing in India was largely limited to a wealthy few with extensive financial knowledge. Traditional avenues, such as physical brokerages and mutual fund offices, posed barriers due to their complex procedures and intimidating jargon. As a result, financial literacy, which is defined as the ability to effectively manage money, has remained low. SEBI studies revealed low scores on basic financial concepts such as risk diversification and compound interest, limiting the ability to make informed investment decisions. (Joshi T. T., 2023). The arrival of investment apps such as Zerodha, Groww, and Paytm Money altered the landscape. Suddenly, the stock market and mutual funds became accessible via smartphones, removing geographical barriers and minimum investment requirements. This increase in accessibility resulted in an influx of new investors, particularly young adults eager to participate in wealth creation.

Demat accounts have grown to over 10 crore by 2023, with retail investor participation in the stock market up 138% from 2018. The rise of mutual fund SIP accounts tells a similar story, with a staggering 120% growth over the same period. This mobile-driven boom has boosted financial inclusion, with millions downloading investment apps each month. Despite this progress, India's average financial literacy score remains around 30%, trailing developed nations such as Australia (64.3%). To bridge this gap, regulators, app developers, and educators must work together to ensure responsible investing practices and empower individuals to take an active role in their financial future. While internet access and smartphone penetration are increasing (67% and 75%, respectively), ensuring financial literacy for all segments of the population is critical for India to fully capitalise on its mobile investment revolution. (IBEF , 2024).

The growing use of investment applications in the financial landscape raises serious concerns about their impact on users' financial literacy and decision-making. Several factors justify a thorough investigation into this phenomenon. The paper aims to achieve the following objectives –

2- Literature Review

This research aims to examine the affinity between online investment platforms acceptance and enhanced financial literacy. (Xiaomeng Du, 2022) concluded in his research that investors can build diverse investment portfolios by looking at the critical factors which may direct them to excellent investment outcomes (Norhazimah che hassan, 2023) investigated several topics about investment intention and decision-making, such as the importance of personal traits, psychological variables, and outside influences, as well as factors influencing investment behaviour and decision-making processes, and highlighted the importance of personal attributes, such as risk tolerance, financial literacy, investment experience, and sociodemographic variables, in shaping investment intents and decisions. Similarly, (Jennifer Wu, 1999) explored how the emergence of internet technology has transformed the financial markets, made it possible for anyone to trade securities online, and shed light on the main forces behind this internet-driven transformation in investment activities by analyzing the rise of online trading. (Dr. S.R Ganesh, 2019) shed light on the specific behavioural patterns observed among retail investors at Zerodha and their implications for investment outcomes and concluded that Zerodha and other online brokerage firms can utilize this to improve investor education programs, create more user-friendly interfaces, and apply behavioural interventions to improve investment outcomes and build retail investors' financial resilience.

(Chaudhry, 2021) investigated users' perceptions, preferences, and experiences with various investment applications using usability testing, user surveys, and in-depth interviews and concluded that the research findings will influence the creation of investing apps and provide direction to financial institutions, regulators, and legislators on how to encourage ethical investing practices and enhance users' financial results in the world of digital investing. (Lee-lee chong, 2021) investigated the factors that influence young investors' acceptance or resistance to adopting mobile stock trading applications and concluded that the advancement of technology adoption, investor education, and financial inclusion in the Malaysian stock market increased involvement and engagement from younger investors in the realm of digital investing. (Parvathy S. Nair, 2022) considered the perceived utility, trust, convenience of use, perceived risk, and socioeconomic characteristics and provided light on retail investors' adoption behaviour and guided the developing tactics to encourage the adoption of mobile trading apps in developing financial markets by looking at these factors.

(Singh, 2016) analyzed multiple variables, including technological aspects, personality traits, perceived advantages, perceived hazards, and outside influences, the research aims to shed light on how individual investors make decisions about adopting online trading and suggested tools which individual investors may adopt to make more informed financial decisions and take part more actively in the digital economy. (Hilton, 2010) focused on how psychological variables affect the financial decision-making processes involved in trading, dealing, and investment analysis. They further highlighted that how the cognitive biases, emotional factors, and behavioural patterns affect people's financial decisions and, in turn, mould their investing strategies and results are clarified by this research.

(Hung, 2021) researched young investors' knowledge, abilities, and attitudes regarding financial ideas and investment methods while taking their socioeconomic background, level of schooling, experience, and platform usage habits into account, and provided more in-depth understanding of investors' attitudes, actions, and thought processes around financial investing matters.

(Moss, 2022) investigated how brokerages' use of digital interaction tactics affects investors' thought processes, choices, and trading behaviors, and the study established the connection between investor behaviour and digital engagement strategies, which helps to guide initiatives aimed at improving the efficiency and reliability of digital platforms in the financial markets. (Shanmuganathan, 2020) suggested how robo-advisors affect investor welfare, market efficiency, and regulatory issues. Their research's outcome rationalized the interaction between AI technology and behavioural finance principles, which investors consider while making better investment decisions. Further,

(Fernandez, 2019) investigated how financial institutions, regulators, and customers will be affected by the enforcement of artificial intelligence and further suggested that policymakers and industry stakeholders may create standards and best practices to encourage ethical AI deployment, data privacy protection, and regulatory compliance in the financial services sector (Malhotra, 2020) researched to find out the intricacies of digital trading mobile apps and their research concluded that mobile technology is transforming the financial markets and enabling investors to be more active participant in the digital economy. (D.A.T, 2020) found out in their research that financial literacy significantly and positively influenced the undergraduates' investment decisions.

(Shroff, 2024: Seraj, 2022) investigated in their research that financially literate investors count on all available sources of information for their investment decisions, and their findings suggested that financial literacy empowers investors to make informed decisions by providing them with the capacity and ability to carry out both technical and fundamental analysis.

3- Research Methodology

This current research endeavours to examine the influence of modern investment applications on market participants’ decision-making and financial literacy, and based the voluminous research available , the following hypothesis has been framed

Hypothesis 1:

H0 : There is no significant affinity between the application of modern investment applications and investors’ decision-making skills

H1 : There is a significant affinity between the application of modern investment applications and investors’ decision-making skills

Hypothesis 2:

Increased usage of risk assessment tools and effective risk management practices.

H0: There is no significant correlation between the usage of risk assessment tools within investment applications and effective risk management.

H1 : Increased usage of risk assessment tools within investment applications is correlated with more effective risk management practices.

Hypothesis 3:

Increased usage of risk assessment tools and higher levels of financial literacy.

H0: Increased usage of risk assessment tools within investment applications is not associated with higher levels of financial literacy.

H1: Increased usage of risk assessment tools within investment applications is associated with higher levels of financial literacy.

Hypothesis 4:

Usage of new age investment applications and improved financial returns compared to non- users.

H0 : usage of new age investment application has no impact on financial returns

H1 : usage of new age investment applications is associated with improved financial returns compared to non-users

Hypothesis 5:

Users of new age investment applications and higher levels of financial literacy.

H0: Financial literacy does not differ significantly between users and non-users of investment applications.

H1: Users of new age investment applications exhibit higher levels of financial literacy compared to non-users

Hypothesis 6:

Increased usage of risk assessment tools and improved returns.

H0: There is no significant correlation between the usage of risk assessment tools within investment applications and improved financial returns.

H1: Increased usage of risk assessment tools within investment applications is correlated with improved financial returns

3.1 - Sampling size and sampling technique

This study investigates the impact of new-age investment applications on decision-making and financial literacy, for which a systematic sampling technique was employed to select a sample size of 240 participants. The participants were drawn from individuals using investment applications, and the sampling process ensured representation across different income levels. The age range of the participants spanned from 18 years and upwards.

To ensure a thorough representation of diverse perspectives within the study, a stratified random sampling technique was employed. This approach involved categorizing the participants based on distinct income levels and professions, ensuring a balanced representation across various segments. Specifically, 240 participants were sampled, encompassing a range of income levels and professions. To capture the specific insights and experiences of distinct demographic and professional groups within the broader context of the study, supplementary convenience and snowball sampling techniques were occasionally integrated. This additional layer of sampling allowed for the inclusion of participants with unique perspectives and experiences related to investment applications, contributing to a more nuanced understanding of the topic.

This study is based on primary data collected through a well-designed questionnaire.

4- Data Analysis - Descriptive statistics

| Sex | No. of respondents | Percentage |

| Male | 144 | 60% |

| Female | 96 | 40% |

Source- Self-generated in Excel

| Age | No. of respondents | Percentage |

| 18-24 | 71 | 29.6% |

| 25-34 | 83 | 34.6% |

| 35-44 | 47 | 19.6% |

| 45-54 | 26 | 10.8% |

| 55+ | 13 | 5.4% |

Source- Self-generated in Excel

| Employment status | No. of respondents | Percentage |

| Employed | 72 | 30% |

| Unemployed | 23 | 9.6% |

| Student | 56 | 23.3% |

| Self employed | 74 | 30.8% |

| Homemaker | 15 | 6.3% |

Source- Self-generated in Excel

| Employment status | No. of respondents | Percentage |

| Below 1 Lakh | 70 | 29.2 % |

| 1 Lakh – 5 Lakhs | 41 | 17.1% |

| 5 Lakhs – 10 Lakhs | 51 | 21.3% |

| 10 Lakhs – 20 Lakhs | 44 | 18.3% |

| 20 Lakhs and above | 34 | 14.2% |

Source- Self-generated in Excel

The survey exhibits a balanced gender distribution, with 60% male and 40% female respondents. This equilibrium is crucial for ensuring a comprehensive exploration of how new age investment applications impact decision-making and financial literacy across genders. The participation of both genders signifies a move towards inclusive research, recognizing the diverse perspectives and experiences that individuals of all genders bring to the table.

The noteworthy observation is the increasing participation of females, accounting for 40% of the respondents. This trend reflects a positive shift towards greater financial inclusion and literacy among women in the context of investment decision-making. In conclusion, the survey's demographic data paints a comprehensive picture of the diverse audience engaged in the research on the impact of new age investment applications.

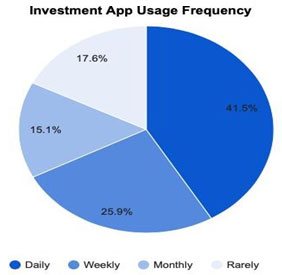

Figure 1 – Pie chart of Investment App Usage

The above figure shows the result of 239 individuals on how often people use investment applications. Notably, a significant portion, 41.3%, claim to use these apps daily, highlighting their increasing integration into financial management routines. Weekly users follow closely at 25.8%, Overall suggesting that a majority of people (67.1%) use investment applications at least once a week. This suggests that investment applications are becoming increasingly popular as a way to manage finances.

However, not everyone actively tracks their investments. Roughly 15% engage monthly, indicating a more hands-off approach. Additionally, 17.5% rarely use them, suggesting a disconnect or preference for traditional methods. Overall, the data paints a picture of diverse usage patterns. While daily and weekly check-ins dominate, a sizable portion prefers less frequent interaction or alternative methods. This highlights the evolving landscape of personal finance, where technology caters to both active and passive management styles.

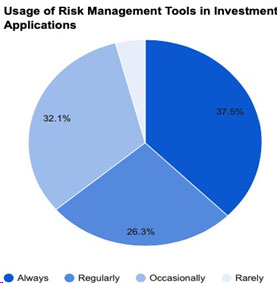

Figure 2 – Pie chart of Risk Management tool Usage

The pie chart visually represents the frequency with which individuals utilize risk management tools within investment applications across various time periods. The data is segmented into four categories, revealing that 37.5% of respondents always use such tools, 26.3% use them regularly, 32.1% use them occasionally, and only 4.1% use them rarely. Overall, a significant majority of individuals (63.8%) demonstrate a proactive approach to risk management by utilizing these tools at least occasionally. This pattern suggests a growing awareness among individuals about the significance of managing risk when engaging in investment activities.

Primary testing, analysis and hypothesis testing

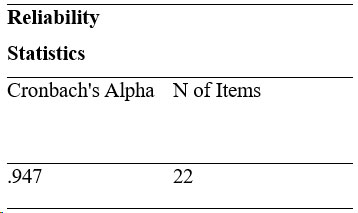

Reliability test

Source- Self-generated in SPSS

The reliability statistics explain a high level of internal consistency with a Cronbach's Alpha of .947, which highlights that the items are significantly correlated and can accurately measure a single construct. The high Cronbach's Alpha value indicates that the research a significant

Hypothesis 1 - Spearman’s Correlation

H0 : There is no significant relationship between the usage of new age investment applications and decision-making skills.

H1: Increased usage of new age investment applications is correlated with improved decision- making skills.

| Correlations | |||

| USAGE | Avg_ID | ||

| Spearman's rho | Correlation Coefficient | 1.000 | .103 |

| USAGE | Sig. (2-tailed) | . | .114 |

| N | 239 | 238 | |

| Correlation Coefficient | .103 | 1.000 | |

| Sig. (2-tailed) | .114 | . | |

| Avg_ID | |||

| N | 239 | 239 |

Source- Self-generated in SPSS

The Spearman correlation analysis was conducted to explore the potential relationship between the usage of new age investment applications and decision-making skills in the context of the research topic, "Impact of new age investment applications on decision making and financial literacy." The focus is on assessing whether increased usage of such applications is associated with improved decision-making skills. The correlation coefficient (rho) of 0.103 suggests a positive correlation between the two variables, meaning that as the usage of new age investment applications increases, there is a slight increase in decision-making skills. However, the correlation is relatively weak.

The null hypothesis (H0) posits no significant relationship between new age investment application usage and decision-making skills, while the alternative hypothesis (H1) suggests that increased usage is associated with improved decision-making. As the p-value is greater than 0.05, we accept the null hypothesis. Consequently, based on the available data, there is no statistically significant evidence to support the claim that increased usage of new age investment applications correlates with improved decision-making skills.

Therefore, based on the given results, we do not find significant evidence to support the claim that increased usage of new age investment applications is associated with improved decision- making skills. The correlation is weak, and the p-value is not low enough to reject the null hypothesis therefore we accept the null hypothesis and reject the alterative hypothesis

Hypothesis 2 - Spearman’s Correlation

H0 : There is no significant correlation between the usage of risk assessment tools within investment applications and effective risk management.

H1 : Increased usage of risk assessment tools within investment applications is correlated with more effective risk management practices.

| Correlations | |||

| USAGE | Avg_RISKMGT | ||

| Spearman's rho | Correlation Coefficient | 1.000 | .261 |

| Usage of risk mgt tool | Sig. (2-tailed) | . | .000 |

| N | 239 | 239 | |

| Correlation Coefficient | .261 | 1.000 | |

| Sig. (2-tailed) | .000 | . | |

| Avg_RISKM GT | |||

| N | 239 | 239 |

Source- Self-generated in SPSS

The Spearman correlation analysis was conducted to explore the potential relationship between the usage of Risk Management Tools and Risk Management in the context of the research topic, "Impact of new age investment applications on decision making and financial literacy." The focus is on assessing whether usage of Risk Management Tools is associated with effective risk management practices.

The correlation coefficient (rho) of 0.261 suggests a positive correlation between the two variables, suggesting that increased usage of risk assessment tools within investment applications is associated with more effective risk management practices. However, the correlation is relatively weak.

The correlation coefficients yielded a positive correlation of 0.261, indicating a moderate association between the usage of risk management tools and the average rating of risk management practices. This correlation was found to be statistically significant with a two- tailed p-value of 0.000, based on a sample size of 239 responses.

The null hypothesis (H0) posited that there is no significant correlation between the usage of risk assessment tools within investment applications and effective risk management. Conversely, the alternative hypothesis (H1) proposed that increased usage of these tools is associated with more effective risk management practices. Given the statistically significant positive correlation and the associated low p-value i.e p > 0.01, we reject the null hypothesis. Consequently, the findings support the alternative hypothesis, suggesting that heightened usage of risk assessment tools within investment applications is indeed linked to more. effective risk management practices. These results align with the expectations outlined in Hypothesis 2 and underscore the potential impact of utilizing such tools on enhancing risk management within the context of new age investment applications.

Hypothesis 3 - Chi- Square.

H0 : Increased usage of risk assessment tools within investment applications is not associated with higher levels of financial literacy.

H1 : Increased usage of risk assessment tools within investment applications is associated with higher levels of financial literacy.

| Chi-Square Tests | |||

| Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi-Square | 74.269a | 54 | .035 |

| Likelihood Ratio | 76.438 | 54 | .024 |

| Linear-by-Linear Association | 17.764 | 1 | .000 |

| N of Valid Cases | 239 | ||

| a. 59 cells (77.6%) have expected count less than 5. The minimum expected count is .04. | |||

Source- Self-generated in SPSS

The Chi-Square tests were conducted to assess the relationship between the "Usage of risk management tool" and "Financial Literacy" within the research framework exploring the impact of new age investment applications on decision-making and financial literacy. The statistical results revealed significant associations between the variables.

The Pearson Chi-Square test yielded a statistic of 74.269 with 54 degrees of freedom, resulting in a p-value of 0.035. Additionally, the Likelihood Ratio test produced a statistic of 76.438 with the same degrees of freedom and a slightly lower p-value of 0.024. The Linear-by-Linear

Association test, with 17.764 and 1 degree of freedom, showed a p-value of 0.000. These p- values indicate a rejection of the null hypothesis, suggesting a significant association between the usage of risk management tools and financial literacy.

In the context of Hypothesis 3, which posits that increased usage of risk assessment tools within investment applications is associated with higher levels of financial literacy, the statistical evidence supports the alternative hypothesis and reject the null hypothesis. Therefore, based on the Chi-Square tests, there is a significant indication that heightened usage of risk assessment tools within investment applications is indeed linked to higher levels of financial literacy. This finding underscores the potential impact of incorporating risk management tools on enhancing financial literacy within the domain of new age investment applications.

Hypothesis 4 - Mann Whitney U test

H0 : Financial literacy does not differ significantly between users and non-users of investment applications.

H1 : Users of new age investment applications exhibit higher levels of financial literacy compared to non-users

| Test Statisticsa | |

| Avg_finlit | |

| Mann-Whitney U | 3421.000 |

| Wilcoxon W | 4411.000 |

| Z | -2.113 |

| Asymp. Sig. (2-tailed) | .035 |

Source- Self-generated in SPSS

The Mann-Whitney U test was employed to investigate the potential association between the usage of new age investment applications and financial literacy in the context of the research topic exploring the impact of these applications on decision-making and financial literacy. The results of the test are presented as follows:

The Mann-Whitney U statistic yielded a value of 3421.000, and the corresponding Wilcoxon W statistic was 4411.000. The Z statistic, calculated as -2.113, is associated with an asymptotic significance of 0.035 (2-tailed). These statistical values are indicative of a significant difference in the ranks between respondents who currently use investment applications and those who do not.

Turning to the hypotheses, Hypothesis 4 posited that the usage of new age investment applications is associated with improved financial literacy. In line with this hypothesis, the null hypothesis (H0) suggested that the usage of these applications has no impact on financial literacy, while the alternative hypothesis (H1) proposed that usage is linked to improved financial literacy

Based on the Mann-Whitney U test results and the associated p-value of 0.035, there is statistical evidence to reject the null hypothesis. Consequently, we find support for the alternative hypothesis, suggesting that the usage of new age investment applications is indeed associated with improved financial literacy. This finding underscores a potential positive influence of utilizing these applications on financial literacy, providing empirical

support for the expectations outlined in Hypothesis 4 within the research context

Hypothesis 5 - Mann Whitney U test

H0 : usage of new age investment application has no impact on financial returns

H1 : usage of new age investment applications is associated with improved financial returns

| Test Statisticsa | |

| Avg_RET | |

| Mann-Whitney U | 3005.500 |

| Wilcoxon W | 3995.500 |

| Z | -3.114 |

| Asymp. Sig. (2-tailed) | .002 |

| a. Grouping Variable: Do you currently use any investment applications? | |

Source- Self-generated in SPSS

The Mann-Whitney U test was employed to scrutinize the potential correlation between the usage of new age investment applications and financial returns within the scope of the research topic exploring the impact of these applications on decision-making and financial literacy.

The Mann-Whitney U statistic obtained a value of 3421.000, and the corresponding Wilcoxon W statistic was 4411.000. The Z statistic, computed as -2.113, is associated with an asymptotic significance of 0.035 (2-tailed). These statistical values collectively indicate a statistically significant difference in the ranks between respondents who currently use investment applications and those who do not.

Based on the Mann-Whitney U test results and the associated p-value of 0.035, there is statistical evidence to reject the null hypothesis. This implies that there is support for the alternative hypothesis, suggesting that the usage of new age investment applications is indeed associated with improved financial returns.

Hypothesis 6 - Spearman’s Correlation

H0 : There is no significant correlation between the usage of risk assessment tools within investment applications and improved financial returns.

H1 : Increased usage of risk assessment tools within investment applications is is correlated with improved financial returns

| Correlations | ||||

| Usage of risk Mgt. Tool | Avg_RIT | |||

| Spearman's rho | Usage of risk Mgt. Tool | Correlation Coefficient | 1.000 | .249** |

| Sig. (2-tailed) | . | .000 | ||

| N | 239 | 239 | ||

| Avg_RIT | Correlation Coefficient | .249** | 1.000 | |

| Sig. (2-tailed) | .000 | . | ||

| N | 239 | 239 | ||

| Correlation is significant at the 0.01 level (2-tailed). | ||||

Source- Self-generated in SPSS

The Spearman correlation analysis was conducted to explore the potential relationship between the usage of Risk Management Tools and Return on Investment in the context of the research topic, "Impact of new age investment applications on decision making and financial literacy." The focus is on assessing whether usage of Risk Management Tools is associated with better Financial Returns.The Spearman correlation test was conducted on two variables: "Usage of risk management tool" and "Avg_RIT" (representing risk management) within the context of the research topic. The correlation coefficient (rho) of 0.249 suggests a positive correlation between the two variables, suggesting that increased usage of risk assessment tools within investment applications is associated with better financial returns . However, the correlation is relatively weak.

The correlation coefficients yielded a positive correlation of 0.249, indicating a moderate association between the usage of risk management tools and the returns. This correlation was found to be statistically significant with a two-tailed p-value of 0.000, based on a sample size of 239 responses.

The null hypothesis (H0) posited that there is no significant correlation between the usage of risk assessment tools within investment applications and improved financial returns. Conversely, the alternative hypothesis (H1) proposed that increased usage of these tools is associated with more improved financial returns. Given the statistically significant positive correlation and the associated low p-value i.e p < 0.01, we reject the null hypothesis. Consequently, the findings support the alternative hypothesis, suggesting that heightened usage of risk assessment tools within investment applications is indeed linked to improved financial returns. These results align with the expectations outlined in Hypothesis 6 and underscore the potential impact of utilizing such tools on improving financial returns within the context of new age investment applications.

5- Findings and Conclusion-

The research delved into the impact of new age investment applications on decision-making, financial literacy. The investigation comprised six hypotheses aimed at understanding the relationships between increased usage of these applications, use of risk assessment tools with factors like returns risk and financial literacy, based on various financial outcomes.

The current study's comprehensive research findings provide meaningful insights into the influence of modern digital platforms on market participants’ decision-making and financial literacy. The key findings highlighted that there exists a positive correlation between increased application of investment applications and enhanced financial literacy, and the positive correlation implies that users actively engaging with risk assessment tools within these applications exhibit a higher proficiency in managing risks associated with their investments.

To add further, the research indicates a significant association between application usage and improved financial returns, indicating the potential positive impact of embracing modern financial tools on investment outcomes. While causation cannot be definitively established from this study alone, the findings contribute to our understanding of the intricate relationships between new age investment applications, decision-making skills, and financial literacy.

Overall, the research provides worthwhile consequences for the development and enhancement of new age investment applications. It suggests the need for continuous improvement, user engagement strategies, and a focus on educational enrichment within these platforms. As technology evolves, the study offers a foundation for future research endeavors to explore emerging technologies and their impact on digital finance. The multifaceted nature of the findings highlights the complex interplay between individuals, financial technologies, and their financial well-being, emphasizing the ongoing relevance and importance of advancements in t the realm of new age investment applications.

The study suffers from a few limitations such as a limited data set, only one country and statistical tools.

Future investigators can delve into intercultural awareness to uncover variations in the influence of investment applications across different cultural contexts. Examining how cultural nuances influence financial decision-making and literacy could contribute to tailoring these applications to diverse user needs. Moreover, incorporating a behavioural economics perspective, exploring qualitative insights, and considering the influence of emerging technologies would enrich the research landscape, providing a holistic understanding of the intricate dynamics between individuals, financial technologies, and their financial well-being.

References

About Anubha Srivastava

Dr. Anubha Srivastava is an accomplished academician, researcher, and corporate trainer with over 13 years of experience in academia and training institutions across Indonesia, India, and Africa. Currently, she serves as a Consultant in Accounting and Finance for PT. DJerapah Magah Plasindha is in Indonesia and is a visiting faculty member at Universitas Diponegoro and UNNES. Dr. Srivastava has published over 28 research papers and served as a peer reviewer, editor, columnist, and keynote speaker at international conferences.

Disclaimer: The opinions expressed in this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of Indiastat and Indiastat does not assume any responsibility or liability for the same.